Business Credit Builders – Introduction

Business Credit Builders – In this detailed guide, we analyze the leading business credit builders to help you identify the best option for your company. Whether you’re launching a small startup or managing an established enterprise, choosing the right business credit builder can greatly influence your financial stability and growth trajectory. Join us as we delve into the top choices for 2024, ensuring your business can flourish.

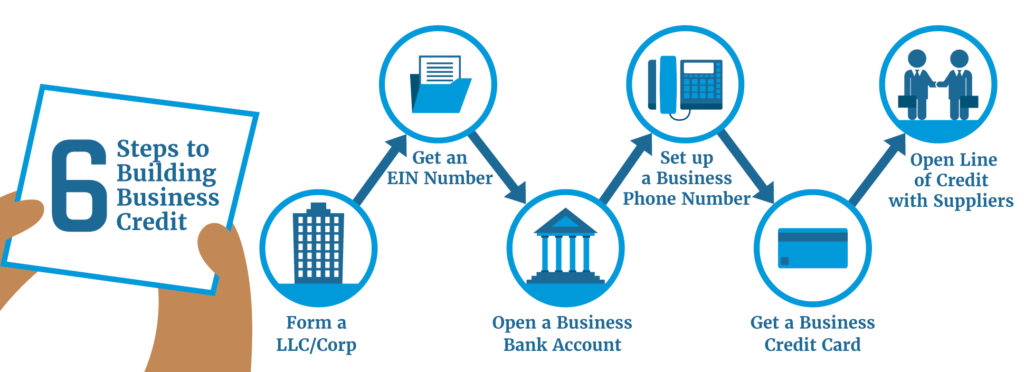

What are Business Credit Builders?

A business credit builder is a service or tool designed to assist businesses in establishing and enhancing their credit profiles. It achieves this by reporting to credit bureaus, offering credit accounts, and providing credit monitoring services.

Key Benefits of Business Credit Builders

- Improved Credit Score: One of the primary advantages of using a business credit builder is the regular reporting to major credit bureaus. This consistent activity helps establish a strong credit history, which is vital for increasing your overall credit score. A higher credit score not only reflects better financial health but also positions your business favorably in the eyes of lenders, making it easier to secure funding in the future.

- Better Financing Options: With an improved credit profile, your business gains access to a wider range of financing options. This includes loans and credit lines with more favorable terms, such as lower interest rates and extended repayment periods. Having better financing options allows you to invest in growth opportunities, manage cash flow effectively, and navigate unexpected expenses with ease.

- Enhanced Credibility: Utilizing a business credit builder enhances your company’s credibility, fostering stronger relationships with suppliers and partners. A solid credit profile signals to vendors that your business is reliable and financially responsible, often leading to improved payment terms and better negotiation power. This increased trust can open doors to new partnerships and opportunities, ultimately contributing to your business’s success.

Unlock Your Business Potential! Start today by exploring how a business credit builder can enhance your credit profile and open doors to better financing options.

Key Features to Look For Best Business Credit Builders

Ease of Use

- User-Friendly Interface and Easy Navigation: A key aspect of any effective business credit builder is its intuitive design. A user-friendly interface ensures that users can quickly find the tools and information they need without frustration. Easy navigation is essential, allowing business owners to seamlessly manage their accounts, monitor their credit status, and access resources, making the experience efficient and pleasant.

- Accessible via Multiple Devices: Modern business owners require flexibility, and a robust credit builder should be accessible on various devices, including desktops, tablets, and smartphones. This multi-device accessibility enables users to manage their credit profiles on the go, ensuring they can stay informed and take action whenever necessary.

Credit Reporting

- Reports to Major Credit Agencies: Effective business credit builders report to significant credit agencies such as Experian, Dun & Bradstreet, and Equifax. This reporting is crucial for establishing a solid credit profile, as it ensures that your business credit activity is visible to lenders and partners.

- Frequency of Reporting: Understanding how often your credit builder reports is vital. Many services provide updates on a monthly or quarterly basis, allowing you to see the progress of your credit profile regularly. Frequent reporting can help you track improvements and make timely adjustments to your credit strategy.

Credit Account Options

- Variety of Credit Accounts: A diverse range of credit accounts, such as trade lines and credit cards, provides flexibility for businesses. This variety allows you to choose the types of credit that best suit your operational needs, whether it’s for everyday expenses or larger investments.

- Flexibility in Terms of Usage and Repayment: Different credit accounts come with varying terms of use and repayment plans. A good credit builder will offer options that allow you to manage your credit effectively, accommodating your cash flow and financial strategy while minimizing the risk of overextension.

Pricing and Fees

- Transparent Subscription Costs: Clarity in pricing is essential when selecting a business credit builder. Look for services that offer straightforward subscription costs without complicated tier structures. This transparency allows you to budget effectively and understand exactly what you’re paying for.

- Absence of Hidden Fees: A reputable credit builder should have no hidden fees that could catch you off guard. Ensuring that all costs are disclosed upfront helps maintain trust and allows you to focus on improving your business credit without worrying about unexpected charges.

Customer Support

- Availability: Reliable customer support is a cornerstone of any good service. Look for providers that offer comprehensive support options, including 24/7 assistance or dedicated business hours on weekdays. Knowing you can get help when you need it is invaluable, especially during critical financial decisions.

- Multiple Support Channels: Effective communication channels enhance user experience. A variety of support options, such as phone, email, and chat, ensures that you can reach out in a way that is most convenient for you. This accessibility helps resolve issues quickly and efficiently, keeping your business on track.

Access Better Financing Options! Don’t let a weak credit profile hold you back. Learn how a business credit builder can provide you with loans and credit lines that offer favorable terms.

Comparison of Top Business Credit Builders

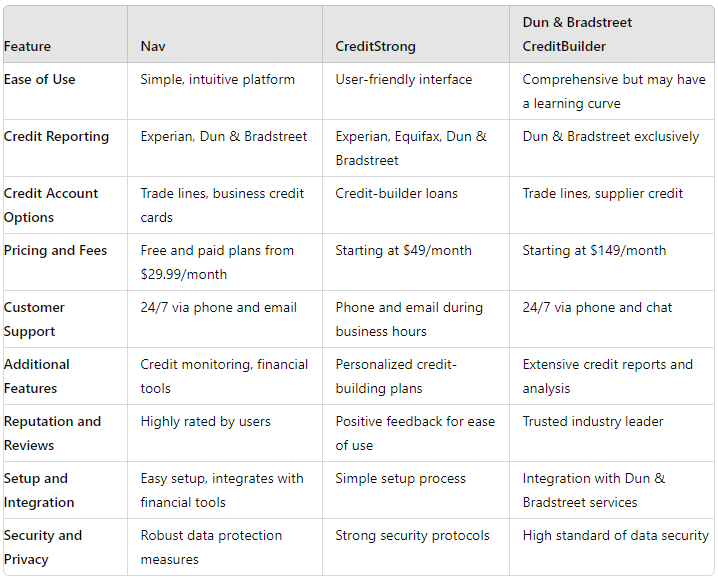

1. Nav

- Ease of Use: Nav provides a user-friendly and intuitive platform that simplifies the process of managing your business credit. Its straightforward navigation allows users, regardless of their technical expertise, to easily access vital information and tools, ensuring a smooth experience when monitoring their credit profiles.

- Credit Reporting: Nav actively reports to two of the major credit bureaus, Experian and Dun & Bradstreet. This reporting helps businesses build a solid credit history, making it easier for them to secure financing and establish credibility with lenders and suppliers.

- Credit Account Options: With Nav, users gain access to a range of credit options, including various trade lines and business credit cards. This flexibility enables businesses to choose the right credit solutions tailored to their needs, whether for everyday expenses or larger investments.

- Pricing and Fees: Nav offers both free and paid subscription plans, catering to different business needs and budgets. The paid plans start at an affordable $29.99/month, providing access to additional features and resources that can enhance your credit-building efforts without breaking the bank.

- Customer Support: Nav ensures its users receive assistance whenever needed, offering 24/7 support via phone and email. This round-the-clock availability is crucial for business owners who may require immediate help or guidance in managing their credit profiles.

2. CreditStrong

- Ease of Use: CreditStrong features a user-friendly interface that includes clear instructions and guidance throughout the credit-building process. This design helps users easily understand how to utilize the platform effectively, making it accessible for everyone, from novice business owners to seasoned entrepreneurs.

- Credit Reporting: CreditStrong stands out by reporting to all three major credit bureaus—Experian, Equifax, and Dun & Bradstreet. This comprehensive reporting approach ensures that your business credit activity is visible across the board, helping you create a robust credit profile that lenders recognize.

- Credit Account Options: CreditStrong specializes in offering credit-builder loans specifically designed for businesses. These loans are tailored to help companies establish and improve their credit while providing an effective way to manage cash flow.

- Pricing and Fees: With transparent pricing, CreditStrong’s plans start at $49/month, ensuring that users know exactly what they are paying for. Importantly, there are no hidden fees, allowing business owners to budget effectively and focus on their credit-building goals without worrying about unexpected costs.

- Customer Support: CreditStrong provides dedicated customer support available via phone and email during business hours. This accessibility enables users to get the help they need when issues arise, ensuring a positive experience while navigating their credit-building journey.

3. Dun & Bradstreet CreditBuilder

- Ease of Use: The Dun & Bradstreet CreditBuilder platform is comprehensive, offering a wealth of features and resources. However, new users may encounter a slight learning curve as they familiarize themselves with the various tools and functionalities available. Once mastered, the platform can be an invaluable asset for managing business credit.

- Credit Reporting: This service exclusively reports to Dun & Bradstreet, a leading credit bureau for businesses. By focusing on this bureau, CreditBuilder helps users enhance their profile with an emphasis on supplier relationships and trade credit, which can significantly impact overall business credibility.

- Credit Account Options: Dun & Bradstreet CreditBuilder primarily focuses on trade lines and supplier credit. This specialization allows businesses to establish strong relationships with vendors and suppliers, ultimately contributing to better credit terms and opportunities for growth.

- Pricing and Fees: The service starts at $149/month, reflecting its comprehensive features and the value it provides. While this price point may be higher than some competitors, the depth of resources and reporting capabilities can justify the investment for many businesses looking to build their credit.

- Customer Support: Dun & Bradstreet CreditBuilder offers robust customer support, available 24/7 via phone and chat. This continuous support ensures that users can get assistance at any time, helping them navigate challenges and maximize the benefits of their credit-building efforts.

Explore Your Options Now! Interested in a business credit builder? Compare different services and find the one that best fits your needs and budget.

How to Choose the Right Business Credit Builders for Your Business

Assess Your Business Needs

Start by evaluating your business requirements. Identify whether you need comprehensive credit reporting, specific types of credit accounts, or advanced monitoring features. Understanding your unique needs will guide you in selecting the most suitable credit builder for your business.

Match Features with Requirements

Next, compare the features offered by each business credit builder against your specific needs. For instance, if robust customer support is essential for you, focus on services that are recognized for their exceptional support teams. This alignment will help ensure that you choose a platform that can adequately support your credit-building journey.

Making the Final Decision

When you’re ready to make a decision, consider starting with a trial or free plan to assess the service firsthand. Additionally, review user feedback and testimonials to confirm that the service meets your expectations and aligns with your business goals.You might also want to download this Free Guide to uncover the hidden credit secrets that could lead you to secure $1 million in funding!

Conclusion – Business Credit Builders

Selecting the right business credit builder is a crucial decision that can profoundly affect your business’s financial health and potential for growth. By clearly understanding your unique needs and meticulously comparing the available options, you can choose a credit builder that aligns with your objectives and budget.

A strong business credit profile not only provides access to improved financing options but also bolsters your business’s credibility with suppliers and partners. Whether you decide on a user-friendly service like Nav with its budget-friendly plans or opt for Dun & Bradstreet CreditBuilder, which focuses on comprehensive trade lines, it’s vital to ensure that the chosen service effectively reports to major credit bureaus and offers the necessary support for your business to flourish.

It’s important to remember that building business credit is a gradual process that requires consistent effort. Regularly monitoring your credit profile, responsibly utilizing available credit accounts, and staying informed about your credit standing are essential practices for maintaining a robust business credit score.

By taking proactive measures and utilizing the right business credit builder, you can secure your business’s financial future, making it resilient and well-positioned for growth in a competitive landscape.

Thank you for exploring this comprehensive guide on business credit builders. I hope this information assists you in finding the ideal solution for your business and paves the way for your financial success.

Invest in Your Growth! With a better credit profile, you can confidently invest in new opportunities. Get started with a business credit builder and pave the way for your business’s success!

Affiliate Disclosure:

I prioritize unbiased perspectives in my content without being swayed by financial incentives. Nonetheless, I partner with specific retailers through affiliate programs to support this website, enabling me to continue offering valuable insights supported by thorough research and practical knowledge. If you make purchases through the links on this page, I may earn modest commissions, which doesn’t increase your costs.